Overview

Have you ever thought about how crucial the quote-to-cash process is for manufacturers? It’s not just a series of steps; it’s the journey from client inquiry all the way to revenue collection. This process directly impacts cash flow and customer satisfaction, which is something we can all relate to, right?

Now, imagine if you could streamline this process. Tools like CPQ and CRM software can make a world of difference! By optimizing your quote-to-cash process, you can boost efficiency, cut down on errors, and ultimately drive your business growth. Sounds appealing, doesn’t it?

Industry leaders are already on board with these streamlined practices. They know that fostering better client relationships and speeding up revenue recognition is key to success. So, why not take a page from their book? Let’s explore how you can enhance your operations and keep your customers happy.

Introduction

Mastering the quote-to-cash process is crucial for manufacturers who want to turn client inquiries into real revenue. This all-encompassing approach not only makes operations smoother but also boosts customer satisfaction, which in turn fuels business growth. But let’s face it, challenges like manual errors and slow payment cycles can really hold you back. So, how can manufacturers effectively optimize this key process to ensure they’re not just efficient but also profitable?

Define the Quote-to-Cash Process

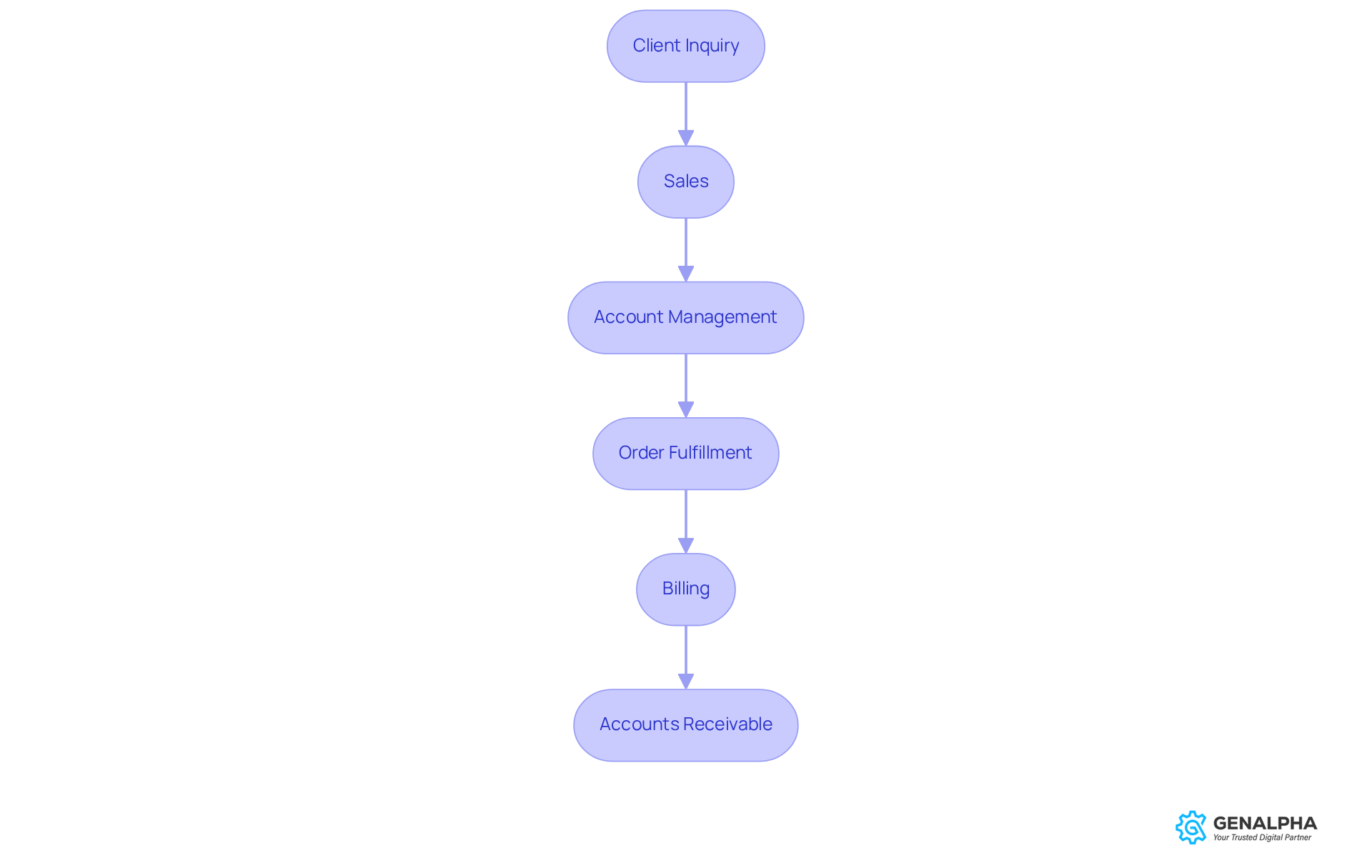

Have you ever wondered how a business turns a simple client inquiry into actual revenue? That’s where the [quote-to-cash process](https://salesforce.com/sales/cpq/quote-to-cash) comes into play! It’s a comprehensive structure that covers every step of the transaction lifecycle, starting from that first chat with a client all the way to receiving the final payment. This approach brings together key functions like:

- Sales

- Account management

- Order fulfillment

- Billing

- Accounts receivable

All working in harmony to convert inquiries into [cash flow](https://billingplatform.com/blog/how-quote-to-cash-management-evolves-into-revenue-operations).

For manufacturers, mastering the quote-to-cash process is crucial. Why? Because it directly impacts cash flow, [client satisfaction](https://blog.genalpha.com/4-ways-to-leverage-pcna-for-equipment-manufacturing-success), and how efficiently operations run. Looking ahead to 2025, companies that fine-tune their quote-to-cash process can expect some impressive improvements. Imagine cutting down the time it takes for quote approvals from the usual 2-3 days to just a fraction of that! By streamlining these practices, manufacturers not only boost their cash flow but also create a more satisfying experience for clients, leading to greater loyalty and repeat business.

Industry leaders are also supportive of the quote-to-cash process! They point out that a well-executed QTC strategy not only speeds up revenue recognition but also strengthens relationships with clients. Just look at the positive outcomes for organizations that have embraced these methods. So, are you ready to dive into the world of QTC and see how it can transform your business?

Outline the Steps in the Quote-to-Cash Process

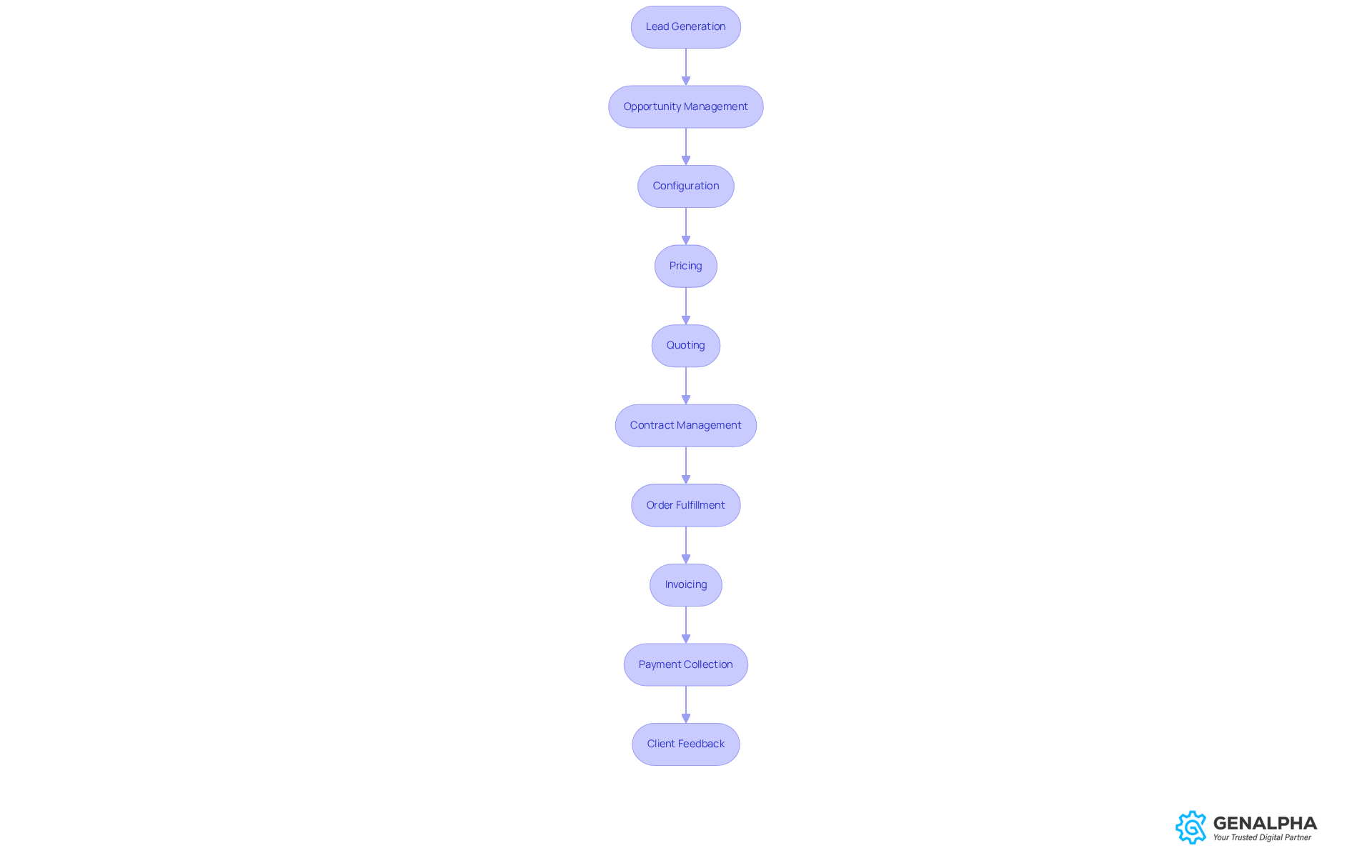

The quote-to-cash process represents a journey that takes us from lead generation to revenue recognition, incorporating critical steps to ensure everything flows smoothly. Let’s break it down:

- Lead Generation: This is where the adventure begins! We focus on spotting potential clients through targeted marketing efforts—this is key for building a robust revenue pipeline.

- Opportunity Management: Here, we qualify leads and assess their potential. This helps our sales teams on the most promising prospects.

- Configuration: Customizing products or services to fit specific client needs is crucial. We often use CPQ (Configure, Price, Quote) software to streamline this process and keep errors at bay.

- Pricing: Setting competitive prices requires a good look at the market and our costs. Getting this right is essential for keeping our clients happy and our profits healthy.

- Quoting: We create formal quotes that lay out pricing and terms. Quick and accurate quotes can really boost our chances of turning prospects into paying clients.

- Contract Management: This step is all about negotiating and finalizing contracts with clients, ensuring everything is clear and accountable.

- Order Fulfillment: We need to process orders efficiently and ensure timely delivery of products or services. This is critical for keeping our clients satisfied and coming back for more.

- Invoicing: Generating accurate invoices for completed orders is a must for maintaining cash flow and financial integrity.

- Payment Collection: Collecting payments and managing accounts receivable effectively helps us avoid cash flow issues and keeps our financial situation stable.

- Client Feedback: Gathering responses after a transaction is essential for ongoing improvement, allowing us to refine our methods and elevate client experiences.

By optimizing each step in the quote-to-cash process, manufacturers can significantly boost efficiency, reduce errors, and enhance customer satisfaction, ultimately driving growth in a competitive marketplace. Did you know that B2B subscription companies that enhance their Q2C system grow four times faster than their competitors? Additionally, when we automate the quote-to-cash process, human errors decrease significantly, making automation a smart choice for manufacturers. However, we still need to tackle challenges like quoting mistakes and lengthy transaction cycles to ensure everything runs seamlessly. Integrating CPQ, contract management, and revenue management is vital for a well-rounded approach to the quote-to-cash process. What steps are you taking to optimize your process?

Identify Tools and Technologies for Optimization

Manufacturers can optimize the quote-to-cash process by utilizing a variety of tools and technologies that enhance efficiency and accuracy.

- Customer Relationship Management (CRM) Software is a must-have for managing customer interactions and data throughout the sales cycle. It ensures that sales teams have access to up-to-date information that can drive better customer engagement and satisfaction.

- Configure, Price, Quote (CPQ) Software simplifies the configuration of intricate products, allowing teams to whip up precise quotes in no time. Organizations using have seen a 28% decrease in sales cycle duration and a 49% rise in proposal volume per representative per month. That’s a significant productivity boost!

- Enterprise Resource Planning (ERP) Systems bring together various business activities—like inventory management, order processing, and financials—offering a comprehensive view of operations that supports informed decision-making.

- Automated Billing Solutions streamline invoicing and payment collection, reducing manual errors and enhancing cash flow management. This means timely payments and improved financial health.

- E-signature and Contract Management Software are essential tools for smoothing out the contract negotiation process. They minimize delays and enhance overall productivity in the quote-to-cash process. Did you know that 18% of an enterprise's revenue cycle is spent on contract creation, negotiation, and approval? This highlights the importance of effective contract management.

- Analytics Tools provide valuable insights into revenue performance, client behavior, and operational effectiveness. Data-driven decision-making is crucial for identifying areas for improvement and optimizing the overall quote-to-cash process.

Integrating CRM and CPQ software not only boosts the efficiency of the quote-to-cash process but also fosters better collaboration among sales, accounting, and product delivery teams. Industry leaders agree that a well-implemented CPQ system can significantly reduce quoting errors, build trust with customers, and ultimately drive higher revenue and customer satisfaction.

Effective communication among stakeholders during the quote stage is key to avoiding breakdowns in the workflow, ensuring smoother transitions from quoting to fulfillment. Additionally, automation helps minimize human errors, further enhancing the accuracy and productivity of the quote-to-cash process.

So, how can you start leveraging these tools to improve your processes? Let’s dive in together!

Address Challenges and Implement Solutions

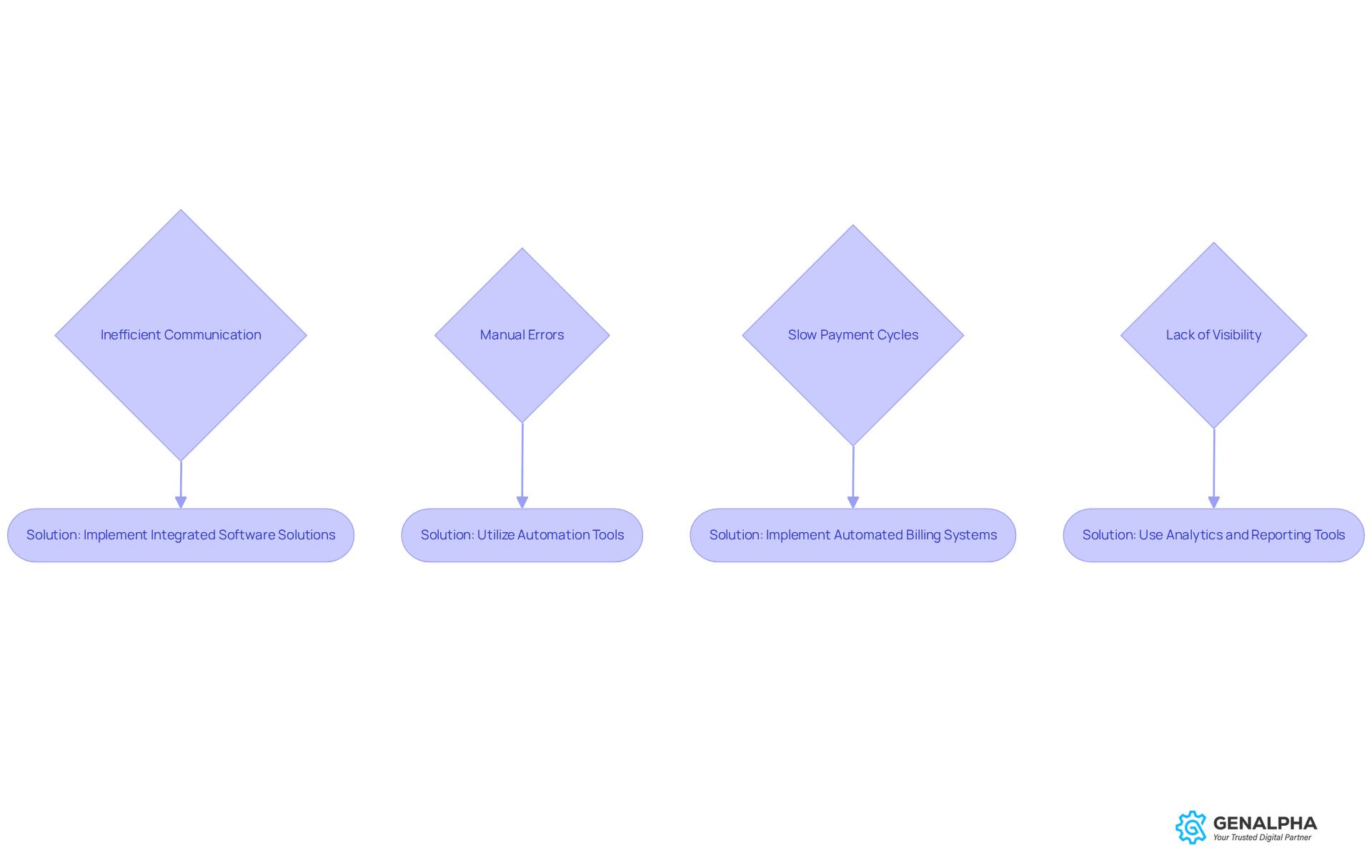

Common challenges in the quote-to-cash process often seem all too familiar, don't they? Let's dive into some of these hurdles and explore how we can tackle them together.

- Inefficient Communication: Ever experienced miscommunication among sales, finance, and operations? It can lead to frustrating delays that impact overall efficiency. Solution: Why not implement integrated software solutions? These can facilitate real-time communication and data sharing, ensuring all teams are aligned and in the loop.

- Manual Errors: We all know that manual data entry can be a recipe for inaccuracies. This often results in financial discrepancies and missed revenue opportunities. Did you know that organizations using CPQ systems can cut quote generation time by up to 40%? That’s a game changer for accuracy and efficiency! Solution: Consider utilizing automation tools to minimize human error and streamline processes, significantly reducing the likelihood of mistakes.

- Slow Payment Cycles: Delays in invoicing and payment collection can really put a strain on cash flow, don’t you think? Solution: Implement automated billing systems that speed up invoicing and provide various payment options for clients. This ensures prompt payments and better cash flow management. Plus, automation can help remind clients of outstanding invoices, further cutting down on delays. Imagine a 99% reduction in manual work—talk about enhancing efficiency!

- Lack of Visibility: Struggling to track the status of quotes and orders? This can lead to client dissatisfaction and missed opportunities. Why not use to gain insights into the quote-to-cash process? This enhances clarity for both teams and clients, allowing for better decision-making and proactive management of customer expectations. And here’s a tip: involve IT teams early in the QTC automation process for a smooth transition. This helps avoid workflow disruptions and ensures that all systems work harmoniously together.

So, which of these challenges resonates with you? Let’s take action and explore solutions together!

Conclusion

Mastering the quote-to-cash process is crucial for manufacturers looking to turn client inquiries into real revenue. This all-encompassing approach not only streamlines operations but also boosts cash flow and customer satisfaction. By managing each stage—from lead generation to payment collection—businesses can create a seamless experience that builds loyalty and drives growth.

So, what are the key steps in the quote-to-cash process? The article highlights the importance of tools and technologies like:

- CRM

- CPQ

- Automated billing solutions

These resources empower manufacturers to optimize efficiency, cut down on errors, and ensure timely payments. Plus, tackling common challenges such as inefficient communication and slow payment cycles is essential for keeping cash flow healthy and clients happy.

But embracing the quote-to-cash process isn't just about improving internal operations; it’s about setting your business up for sustainable success in a competitive landscape. Manufacturers should take proactive steps to:

- Refine their processes

- Leverage technology

- Encourage collaboration among teams

By doing this, they can unlock the full potential of their operations, ultimately achieving greater profitability and customer satisfaction.

So, are you ready to take your quote-to-cash process to the next level? Let's get started on this journey together!

Frequently Asked Questions

What is the quote-to-cash process?

The quote-to-cash process is a comprehensive structure that covers every step of the transaction lifecycle, starting from the initial client inquiry to receiving the final payment. It includes key functions such as sales, account management, order fulfillment, billing, and accounts receivable.

Why is the quote-to-cash process important for manufacturers?

Mastering the quote-to-cash process is crucial for manufacturers because it directly impacts cash flow, client satisfaction, and operational efficiency.

What improvements can companies expect by fine-tuning their quote-to-cash process by 2025?

Companies that refine their quote-to-cash process can expect significant improvements, such as reducing the time it takes for quote approvals from the usual 2-3 days to a much shorter timeframe.

How does a well-executed quote-to-cash strategy benefit organizations?

A well-executed quote-to-cash strategy speeds up revenue recognition and strengthens relationships with clients, leading to greater client loyalty and repeat business.

What are the key functions involved in the quote-to-cash process?

The key functions involved in the quote-to-cash process include sales, account management, order fulfillment, billing, and accounts receivable.