Overview

Have you ever wondered if extended warranties are really worth the investment? This article dives into just that, helping you figure out what to consider before making a decision.

Think about it:

- your vehicle's reliability

- the different coverage options available

- how the costs stack up against potential repair bills

- the reputation of warranty providers

By taking a good look at these factors, you can make an informed choice that fits your specific needs. So, let’s break it down together and see what makes sense for you!

Introduction

Extended warranties often promise peace of mind, but do they really deliver value? As we navigate the complexities of purchasing extended coverage for our vehicles, it’s crucial to understand the nuances of these agreements.

This article dives into the key factors that can help us decide if investing in an extended warranty is a smart move. We’ll highlight the balance between potential costs and the benefits of added protection.

With repair costs on the rise and consumer satisfaction varying widely, we’re left wondering: are extended warranties a safeguard against unexpected expenses, or just an unnecessary cost?

Understand Extended Warranties and Their Purpose

Extended guarantees, often referred to as service contracts, are agreements that extend the protection of a product beyond its standard coverage period. They’re designed to protect you from unexpected repair costs once the manufacturer's warranty runs out. Understanding the purpose of these guarantees is key, especially for . But remember, not every product needs extra protection, and whether extended warranties are worth it often depends on how reliable the product is and your own financial situation.

Coverage Duration: Typically, extended warranties cover repairs for a certain period after the original warranty expires, usually lasting anywhere from two to seven years.

Types of Coverage: The options can vary widely—from comprehensive plans that cover nearly all repairs to limited plans that only cover specific parts. For example, luxury vehicles might offer bumper-to-bumper protection for up to four years or 50,000 miles, while powertrain warranties can last as long as ten years or 100,000 miles.

Consumer Insights: Did you know that 47% of vehicle owners have an extra protection plan? Interestingly, 41% of those folks are satisfied with their third-party coverage. However, it’s worth noting that 55% of consumers who bought additional coverage never even used it! This really highlights the importance of assessing whether extended warranties are worth it for your individual needs before diving in. Plus, 32% of consumers skip the extra coverage because they don’t think they’ll ever need it.

Expert Opinions: Consumer advocates stress the importance of understanding the terms of extended coverage. It’s crucial to ask about exclusions, diagnostic fees, and which service centers you can use to ensure you’re adequately protected. On average, a guarantee repair takes about 12 days, which is an important factor to keep in mind.

By considering these factors, along with the average yearly cost of owning and operating a new vehicle in 2023, which was $12,182, you can better determine if extended warranties are worth it for your needs. Ultimately, this understanding can enhance your purchasing experience.

Evaluate Key Factors Before Purchasing

Before you dive into purchasing an extended warranty, let’s chat about a few key factors that can really shape your decision.

- Vehicle Reliability: First off, how reliable is your vehicle model? It’s worth doing a little homework here. Frank Hanley, senior director of auto benchmarking at J.D. Power, points out that "the average age of vehicles on American roads today is approximately 12 years, which underscores the importance of building a vehicle designed to stand the test of time." If your vehicle has a track record of frequent repairs, that might just highlight the need for an extended warranty.

- Coverage Options: Next, let’s talk about what the warranty actually covers. Some plans might leave out important details, so make sure to comb through the fine print. You don’t want any surprises down the road!

- Cost vs. Possible Fixes: Now, consider the cost of the warranty versus potential repair bills. For instance, if you own a vehicle known for high failure rates, those repair costs can really add up. An extended warranty could be a smart financial move if you anticipate major repairs. Remember, "new cars typically include a manufacturer’s guarantee covering defects for a limited period, often three years or 36,000 miles." This really emphasizes the need to evaluate your vehicle's age and reliability.

- Duration of Coverage: How long do you plan on keeping your vehicle? If you’re thinking about selling it before the warranty runs out, check if it’s transferable to the new owner. This could !

- Provider Reputation: Lastly, do a little digging on the warranty provider. Look for customer reviews and ratings to ensure they have a solid reputation for honoring claims and providing great customer service.

By taking the time to assess these factors, you'll be better equipped to determine if extended warranties worth it is the right investment for your vehicle.

Analyze Costs and Benefits of Extended Warranties

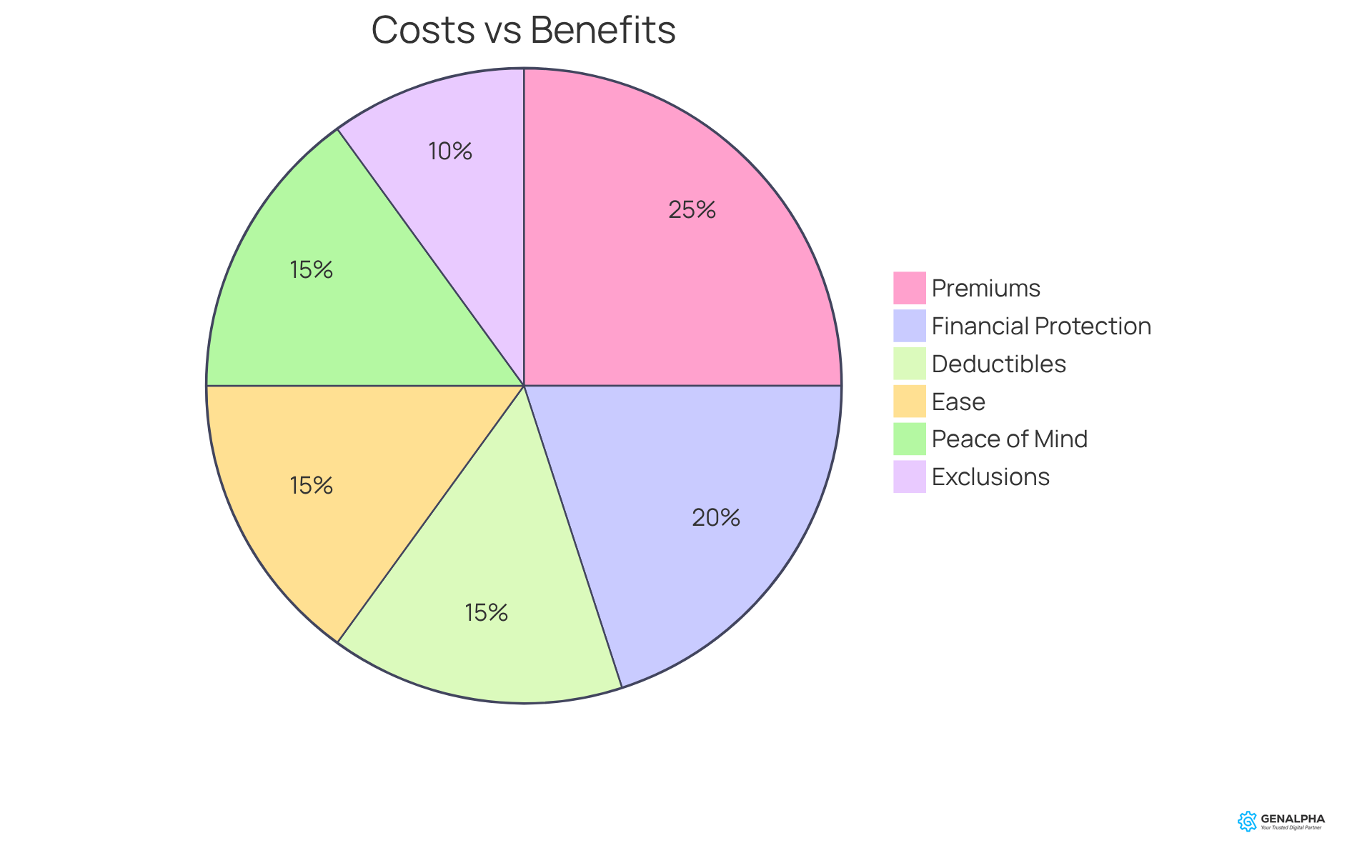

When considering if are worth it, it's important to weigh both the costs and the potential benefits. So, let’s break it down:

Costs:

- Premiums: Extended warranties usually come with upfront payments or monthly premiums that can really add up over time. On average, you might be looking at costs ranging from $1,400 to $4,000 annually, depending on the coverage level you choose.

- Deductibles: Many warranties include deductibles that you’ll need to pay out-of-pocket when making a claim. These can vary, typically falling between $0 and $1,000, which can impact your overall expenses.

- Exclusions: It’s super important to know what’s not covered by the warranty. Common exclusions include damage from pre-existing conditions, routine maintenance, and wear-and-tear items, which could lead to unexpected out-of-pocket costs.

Benefits:

- Financial Protection: Extended warranties can save you a ton on major repairs, especially for critical parts like engines and transmissions. For instance, fixing a transmission can start at about $3,000, and more extensive repairs can easily range from $4,000 to $8,000. Having a warranty can be a smart way to shield yourself from these hefty costs.

- Ease: An extended warranty makes maintenance a breeze since you often won’t have to pay upfront for repairs. The warranty provider usually handles payments directly, simplifying the whole experience.

- Peace of Mind: Knowing you have protection can really ease the stress of potential repair bills. Many folks feel that the comfort of having a warranty is worth the investment, especially since the average age of vehicles on U.S. roads has climbed to 12.5 years, increasing the likelihood of needing repairs.

By taking a closer look at these costs and benefits, you can make an informed decision about whether investing in an extended warranty is worth it for your financial needs and situation. What do you think? Is it worth it for you?

Make an Informed Decision on Extended Warranties

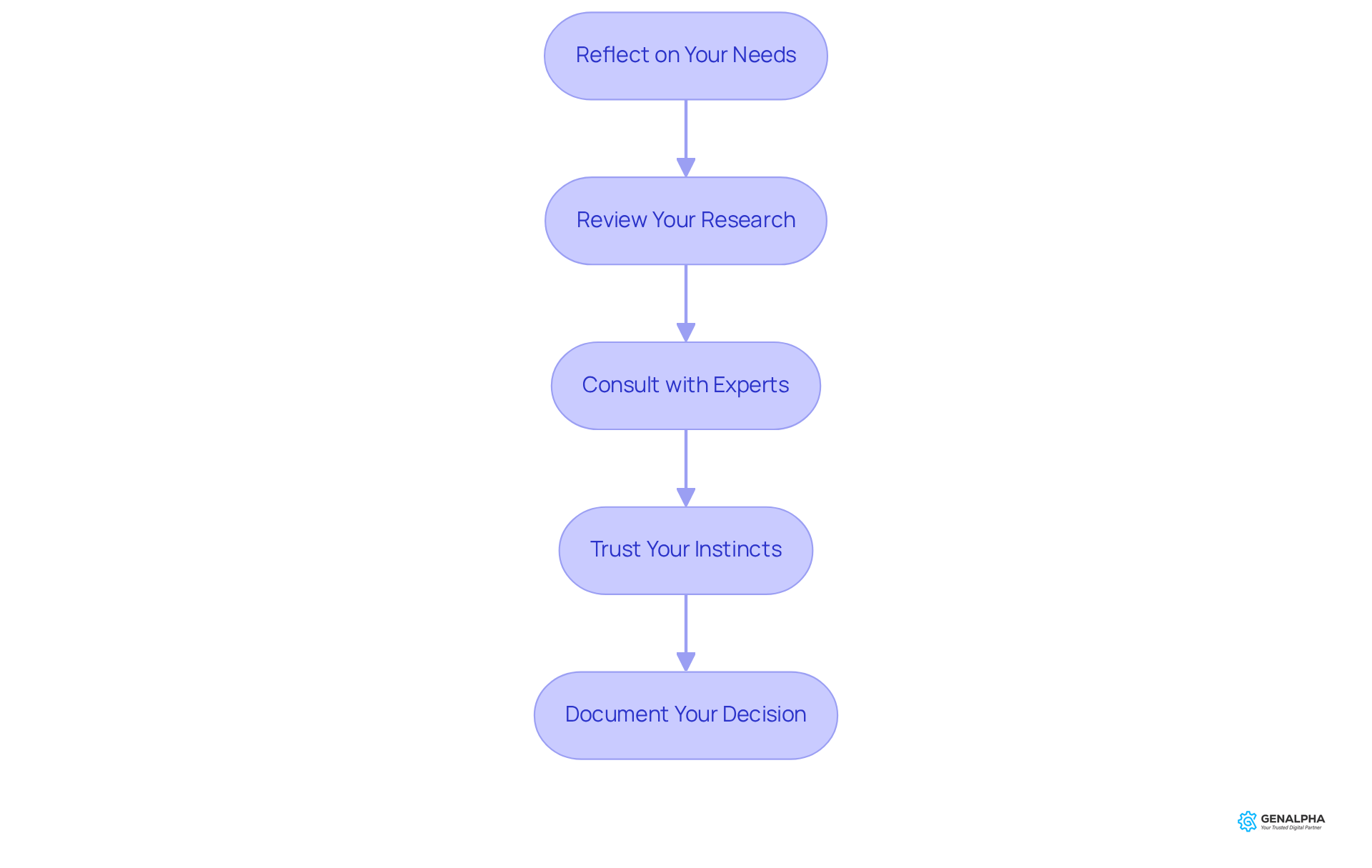

After thinking about the purpose, key factors, and the costs versus benefits of extended warranties, let’s dive into how to make a smart choice:

- Reflect on Your Needs: Take a moment to consider your financial situation, how long you plan to keep your vehicle, and how comfortable you are with potential maintenance costs. Understanding your personal circumstances is crucial—did you know that 58% of Americans say they couldn’t handle an unexpected vehicle repair bill? With repair costs soaring, it is important to evaluate whether to provide essential financial peace of mind.

- Review Your Research: Look over the information you’ve collected about different warranty providers, coverage options, and their costs. This means understanding the differences between standard and extended warranties, along with any specific terms and conditions that might apply.

- Consult with Experts: Don’t hesitate to reach out to trusted mechanics or consumer advocates for their insights. Research shows that many consumers seek expert advice before making a purchase—this highlights the importance of informed opinions. Experts emphasize the need for thorough research to avoid misleading offers and ensure clarity in your warranty choices.

- Trust Your Instincts: In the end, go with your gut. If you believe that an extended warranty will bring you value and peace of mind, you may wonder if extended warranties are worth it as a wise investment. Remember, the right coverage can serve as a financial safety net, especially as vehicle repair costs continue to rise.

- Document Your Decision: Keep detailed records of your warranty purchase and any communication with the provider. This documentation can be incredibly helpful for future reference and claims processes.

By following these steps, you can confidently decide if extended warranties are worth it as a smart investment tailored to your needs.

Conclusion

Understanding the value of extended warranties is all about taking a closer look at what they really offer, the coverage options available, and the financial implications involved. These service contracts can really bring peace of mind when it comes to unexpected repair costs, especially if you own a high-maintenance vehicle. But remember, they aren’t always necessary, and their value often depends on your unique situation—like how reliable the product is and your personal financial situation.

So, what should you think about before diving into an extended warranty? First off, consider your vehicle’s reliability. Next, get to know the coverage options out there. It’s also a good idea to analyze the costs compared to potential repair expenses and check out the reputation of warranty providers. Plus, finding the right balance between the comfort of having that coverage and the reality of its costs can really help you make informed choices. With many consumers either not using their warranties or feeling unsure about their necessity, it’s clear that doing your homework and reflecting on your needs is key.

In the end, deciding whether to invest in an extended warranty should be all about what fits your individual needs and circumstances. As vehicle repair costs keep climbing, the idea of financial protection can sound pretty appealing. By taking the time to weigh the benefits against the costs and chatting with experts, you can make sure your decision aligns with your financial goals and gives you peace of mind. Engaging in this process not only leads to better purchasing decisions but also empowers you to navigate the complexities of warranty options with confidence.

Frequently Asked Questions

What are extended warranties and their purpose?

Extended warranties, also known as service contracts, are agreements that provide protection for a product beyond its standard warranty period. They are designed to cover unexpected repair costs once the manufacturer's warranty expires.

How long do extended warranties typically last?

Extended warranties usually cover repairs for a period ranging from two to seven years after the original warranty expires.

What types of coverage are available with extended warranties?

Coverage options can vary widely, from comprehensive plans that cover nearly all repairs to limited plans that only cover specific parts. For instance, luxury vehicles may offer bumper-to-bumper protection for up to four years or 50,000 miles, while powertrain warranties can extend to ten years or 100,000 miles.

What do consumer statistics say about extended warranties for vehicles?

Approximately 47% of vehicle owners have an extra protection plan, with 41% of those satisfied with their third-party coverage. However, 55% of consumers who purchased additional coverage never used it, and 32% opted out of extra coverage because they believed they wouldn't need it.

What should consumers consider before purchasing an extended warranty?

Consumers should understand the terms of extended coverage, including exclusions, diagnostic fees, and approved service centers. This knowledge is crucial for ensuring adequate protection.

How long does it typically take to repair a guarantee under an extended warranty?

On average, a guarantee repair takes about 12 days.

How can the average yearly cost of owning a vehicle influence the decision on extended warranties?

Considering the average yearly cost of owning and operating a new vehicle in 2023, which was $12,182, can help individuals assess whether extended warranties are worth the investment based on their specific needs.